BIR Amendment of Registration

Official Update of Business Information with the BIR (e.g., Name, Address, Line of Business)

This service facilitates the amendment of registered business details with the Bureau of Internal Revenue (BIR), ensuring that your Certificate of Registration (COR) and BIR records are updated to reflect the latest legal, structural, or operational changes to your business.

Who Is This For?

Businesses undergoing changes in location, structure, or branding, especially after an SEC or DTI amendment, business pivot, or expansion.

How Long Does It Take?

5–10 business days depending on RDO schedule and document completeness.

What If I Don’t Have All My Information Yet?

JKNC can help retrieve old records and guide you on preparing or securing needed amendments.

Will JKNC Do the Filing/Execution?

Yes. This is a full-service deliverable including portal scheduling, RDO handling, and certificate retrieval.

Will It Be Accepted by Government Agencies and Bodies?

Yes. The updated COR will be recognized for all tax, bank, licensing, and audit purposes.

Can Foreign Entities Use This?

Yes, for registered corporations or branches with valid SEC registration and Philippine operations.

Is This Confidential and Protected?

Yes. All identity and tax records are processed under strict confidentiality and compliance with the Data Privacy Act.

How Does This Connect with Other JKNC Products?

SEC or DTI Amendments (source of change)

Mayor’s Permit Renewal/Update

Corporate Profile Realignment

Compliance Calendar & Document Monitoring Retainer

What Comes Next After This Deliverable?

Inform LGU and other agencies of the amendment

Update bank records and billing documents

Add to Annual Compliance Tracker

Optional: JKNC Retainer for Continuous Regulatory Alignment

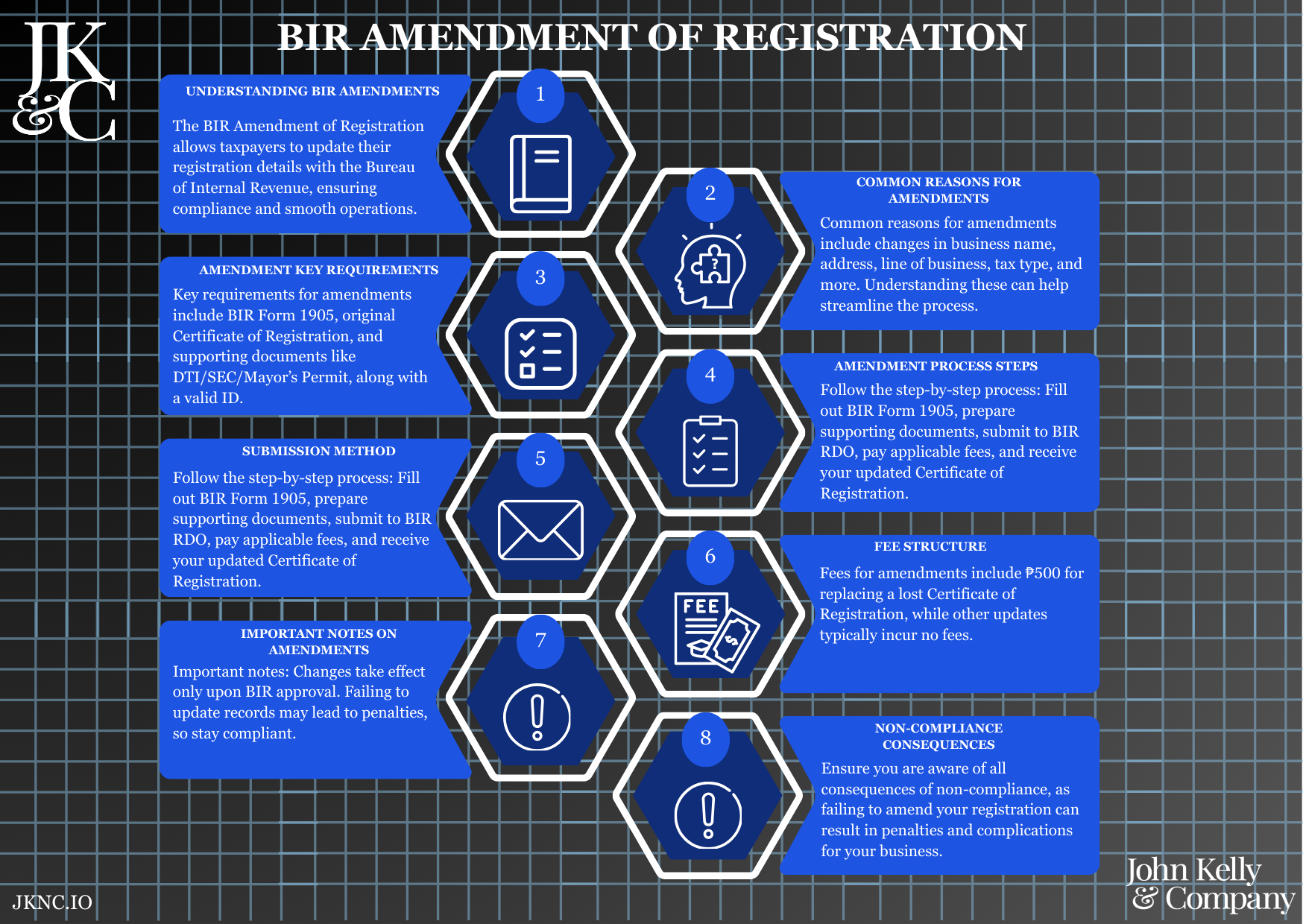

A structured and compliant update process for modifying business data in the BIR system, covering updates such as business name, trade name, business address, tax type, and business line.

Keeps your BIR records current and consistent with SEC, DTI, and LGU records

Prevents legal penalties due to outdated tax records

Enables seamless invoicing, banking, and licensing processes

Supports business expansion, rebranding, or relocation

Identify change (e.g., new address, name) and prepare documents

JKNC completes and submits BIR Form 1905 and supporting files

Client receives an updated Certificate of Registration

Review existing BIR COR and validate current status

Identify type of change (address, business name, etc.)

Draft BIR Form 1905 and other required forms

Prepare supporting documents (e.g., amended SEC or DTI certificate, new lease contract)

Submit to RDO and monitor status

Secure and deliver updated COR

Existing Certificate of Registration (COR)

Official document reflecting the amendment (e.g., SEC Certificate of Amendment, new Mayor’s Permit, lease)

Valid ID of business owner or corporate signatory

Board Resolution (for corporations)

Proof of address (if amending location)

Business address change

Trade or corporate name change

Tax type update (e.g., VAT registration)

Line of business update

Other non-TIN information amendments

Updated Certificate of Registration

Updated BIR COR (PDF + physical, if needed)

Stamped BIR Form 1905 and proof of filing

Online support session available for briefing (optional)

Advisory and document alignment included for bundled clients