BIR Branch Registration

Official BIR Registration for New Branches Under Existing Business TIN

This service registers a new branch office or place of business with the Bureau of Internal Revenue (BIR) under your existing business TIN. It includes coordination with the Revenue District Office (RDO), registration of branch-specific books of account, and the issuance of a Branch Certificate of Registration.

Who Is This For?

Businesses expanding their physical presence by opening new branches or sales offices—whether commercial, administrative, or satellite operations.

How Long Does It Take?

7–14 business days depending on location, RDO, and document readiness.

What If I Don’t Have All My Information Yet?

JKNC helps you validate documents, prepare resolutions, and comply with RDO-specific requirements.

Will JKNC Do the Filing/Execution?

Yes. We handle full coordination with BIR—including cross-RDO updates—unless advisory-only is selected.

Will It Be Accepted by Government Agencies and Bodies?

Yes. The branch COR is legally required for invoicing, licensing, and operations recognition.

Can Foreign Entities Use This?

Yes, if they already have a registered main office in the Philippines via SEC. Branch registration is applicable under Philippine jurisdiction.

Is This Confidential and Protected?

Yes. Branch and tax data are handled under strict compliance with the Data Privacy Act.

How Does This Connect with Other JKNC Products?

LGU Branch Licensing

Branch POS Registration

Tax Calendar and Compliance Monitoring

BIR Filing Retainers (Multi-Branch)

What Comes Next After This Deliverable?

File applicable BIR forms per branch monthly/quarterly

Coordinate with LGU for Mayor’s Permit

Report to main office for consolidated tax reporting

Optional: Enroll in JKNC Multi-Branch Compliance Retainer

A full-service compliance process to legally recognize a new branch location for tax and invoicing purposes, aligned with your company’s main registration.

Ensures legal recognition of multiple operating sites

Allows issuance of official receipts/invoices under branch name

Avoids tax and operational penalties due to unregistered branches

Enables structured revenue monitoring and tax declarations per site

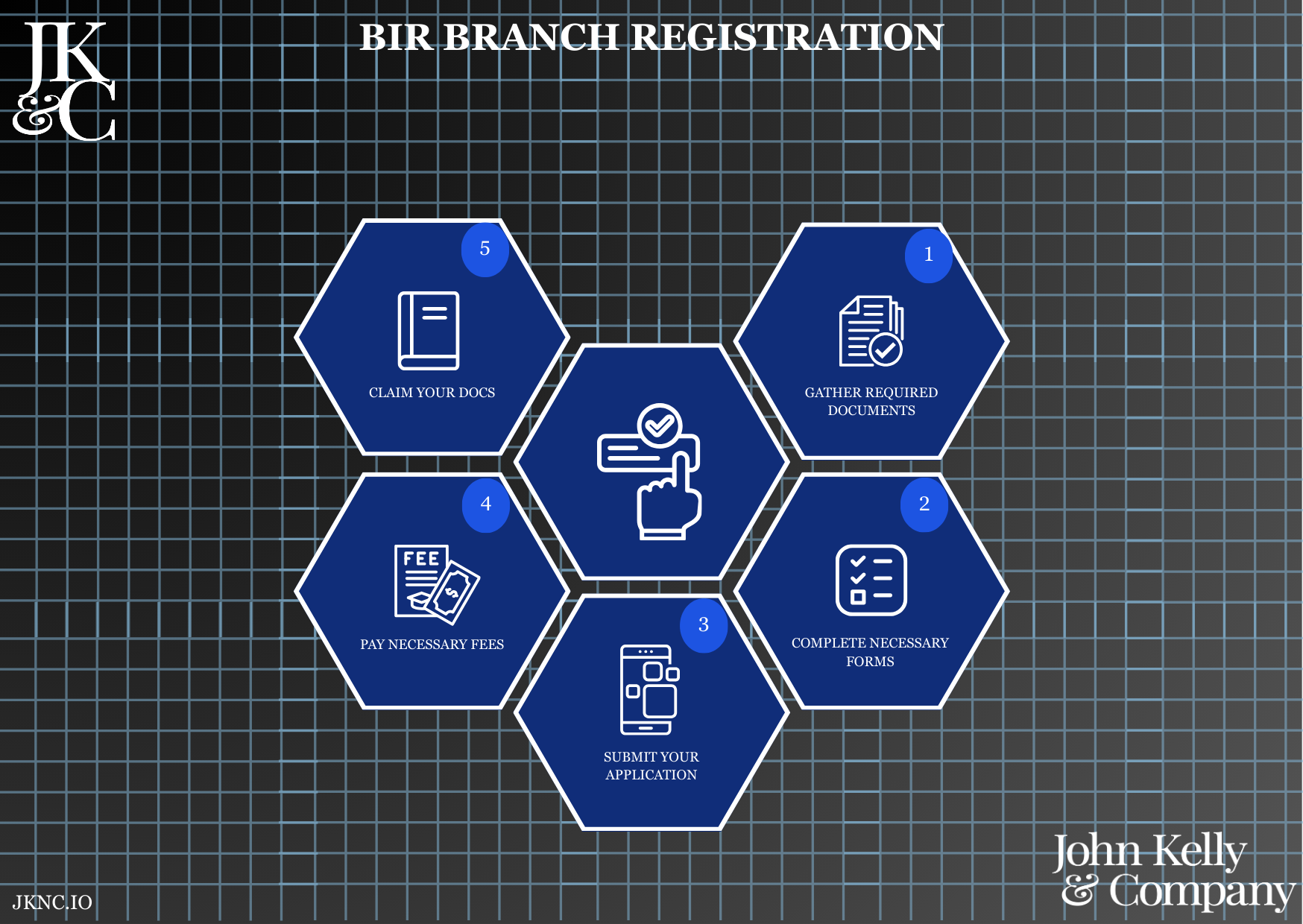

Identify branch address and prepare lease or ownership documentation

Submit required corporate documents

JKNC processes registration with the appropriate RDO and delivers Branch COR and books

Collect documents related to parent company and new branch

Complete BIR Form 1903 or 1905 (Branch)

Coordinate with the new RDO based on branch location

Submit documents and process payments

Secure Branch Certificate of Registration

Register new Books of Account and/or POS

Deliver full compliance kit to client

Parent BIR Certificate of Registration (main office)

Valid Mayor’s Permit or proof of application for branch

Valid Lease Contract or proof of ownership for new address

Board Resolution or Secretary’s Certificate (corporations)

Valid IDs of authorized signatories

Barangay clearance (branch)

Branch registration under existing TIN

RDO coordination based on geographic location

COR issuance for branch

Book of Account registration

Orientation on tax type (e.g., VAT/non-VAT branch)

Branch BIR Certificate of Registration (COR), Stamped Forms, Book registration slips (PDF + physical if needed)

Optional online session for branch compliance briefing

Support for tax coordination and filing schedules included