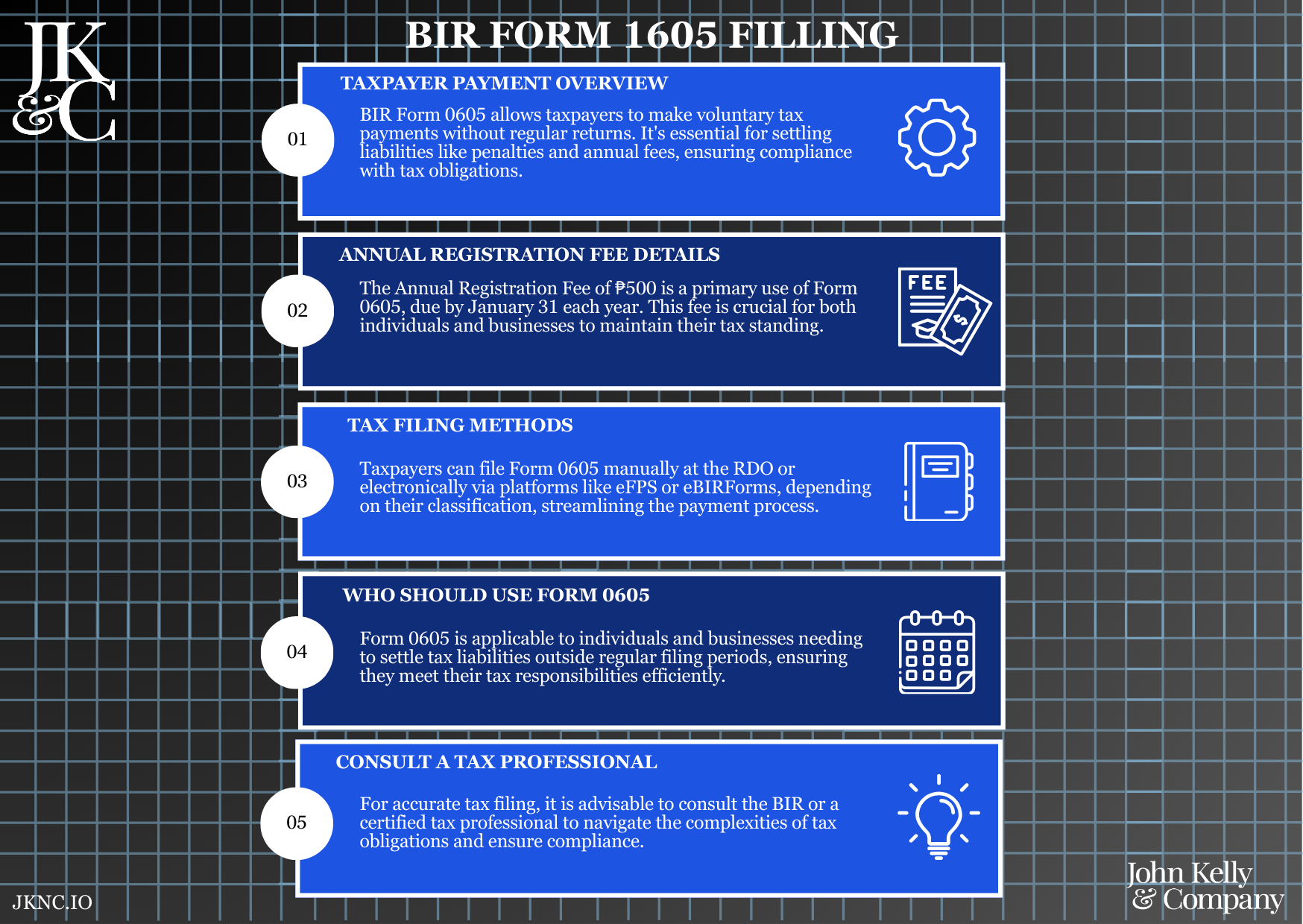

BIR Form 0605 Filing

Annual Registration Fee Payment for Business Continuity Compliance

This service ensures timely filing and payment of the ₱500 Annual Registration Fee (ARF) using BIR Form 0605, which is mandatory for all registered businesses regardless of income or tax activity. Non-payment results in penalties and audit red flags.

Who Is This For?

All BIR-registered businesses—sole proprietors, OPCs, corporations, freelancers, and partnerships—regardless of income level.

How Long Does It Take?

24–48 hours for preparation + payment coordination

Same-day service available for last-minute compliance

What If I Don’t Have All My Information Yet?

JKNC can retrieve your COR, verify with BIR, or file under “inactive” status to avoid penalties while records are reconstructed.

Will JKNC Do the Filing/Execution?

Yes. JKNC handles full form generation, filing, and payment unless you choose advisory-only.

Will It Be Accepted by Government Agencies and Bodies?

Yes. This is an official BIR compliance requirement and proof of good standing.

Can Foreign Entities Use This?

Yes, if operating as BIR-registered entities in the Philippines.

Is This Confidential and Protected?

Absolutely. Your TIN, branch, and payment records are encrypted and stored securely.

How Does This Connect with Other JKNC Products?

Mayor’s Permit Renewal

Form 1702 / 2550Q / 2551Q Filing

Annual Financial Statement Filing

Full-Year Compliance Retainer

What Comes Next After This Deliverable?

Add to your BIR Inventory File

Proceed with Quarterly and Annual Tax Filings

Avoid repeat manual prep by enrolling in JKNC’s automated compliance schedule

Optional: Add to JKNC's Annual Audit Trail Folder for inspection readiness

A once-a-year compliance service to generate, file, and process BIR Form 0605 before the January 31 deadline, with payment facilitation and submission proof for your audit file.

Ensures your BIR registration remains active and penalty-free

Avoids ₱1,000 penalty + 25% surcharge + interest for non-payment

Required for annual business renewal, eFPS continuity, and eAccReg filing

Establishes you as a compliant entity in the eyes of the BIR

Provide BIR details or Certificate of Registration

JKNC generates the Form 0605 and payment instructions

You or JKNC settles the ₱500 payment

Receive official proof of filing and compliance archive

Verify taxpayer status and TIN via COR or BIR eFPS

Prepare BIR Form 0605 with correct tax type and ATC code

Coordinate with RDO or AAB for payment filing

Secure stamped or digitally validated form

Deliver digital copy and confirm with client for audit folder

BIR Certificate of Registration (Form 2303)

Previous Form 0605 (if available)

TIN + Branch Code

Valid ID of business owner or corporate officer

Authorization (if filing on behalf)

Preparation of BIR Form 0605

Payment coordination (client pays or via JKNC float)

Official filing acknowledgment

Annual compliance archive with filing schedule

PDF Form 0605 + eFPS receipt or stamped AAB copy

Annual Compliance Certificate (optional)

Quick consult (optional) for bundled clients or first-time payers

Priority in-person support available within Metro Cebu