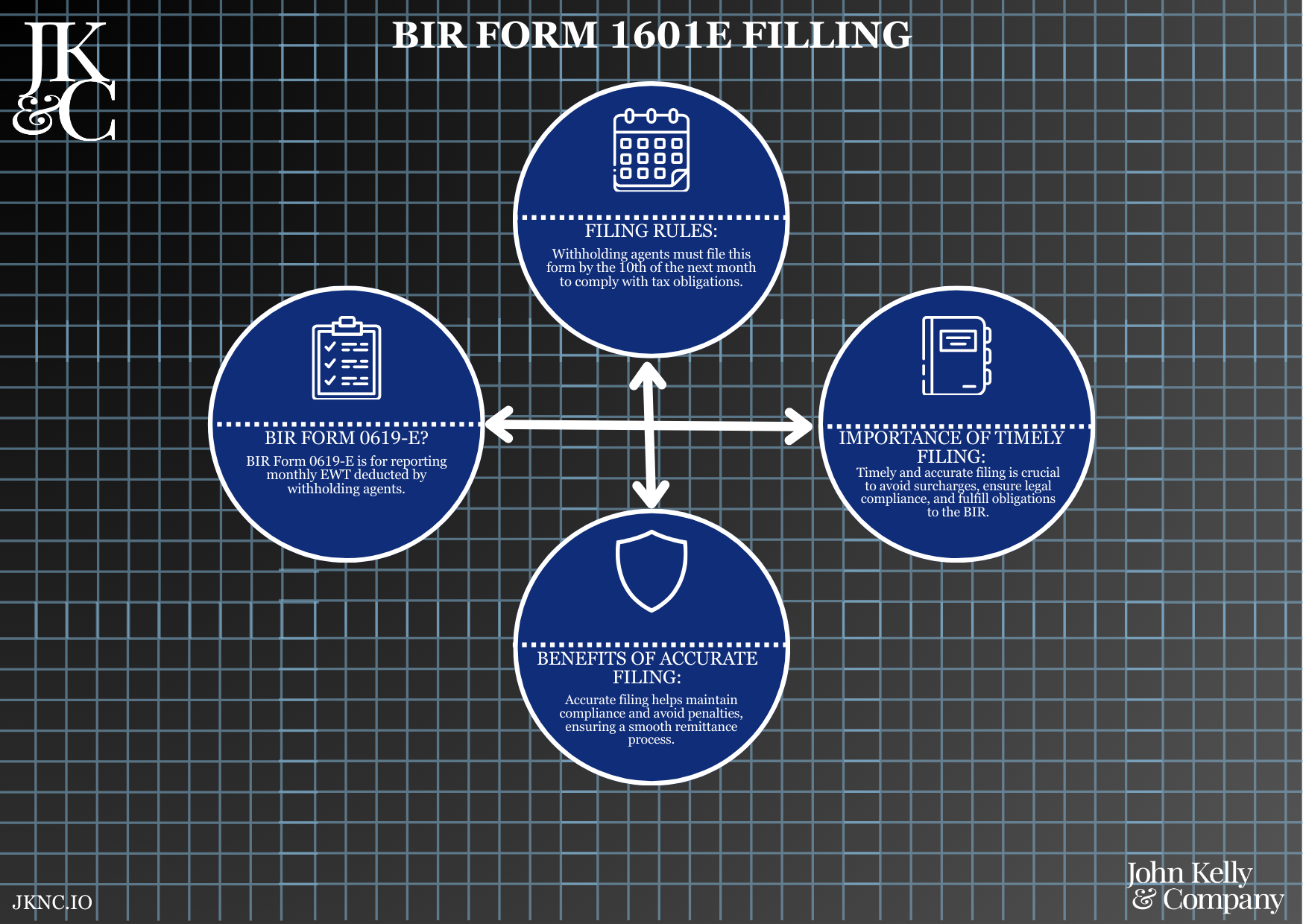

BIR Form 0619E Filing

Monthly Expanded Withholding Tax Return Filing and Payment

This service supports the monthly computation, filing, and payment of Expanded Withholding Tax via BIR Form 0619E. It ensures your obligations for withholding on professional fees, rentals, commissions, and other income payments are properly declared and remitted to the BIR.

Who Is This For?

All BIR-registered businesses making payments that require expanded withholding—such as freelancers, consultants, landlords, and suppliers.

How Long Does It Take?

1–3 business days per month

Rush filing available for close deadlines

What If I Don’t Have All My Information Yet?

JKNC provides a Withholding Setup Worksheet or can help reconstruct your monthly payee report.

Will JKNC Do the Filing/Execution?

Yes. We prepare, file, and optionally pay for you—unless you choose a prep-only package.

Will It Be Accepted by Government Agencies and Bodies?

Yes. All filings are official, confirmed with BIR, and accepted for audits, supplier validations, and cross-checks.

Can Foreign Entities Use This?

Yes, if operating as Philippine-registered payors (domestic or branch-based) with EWT obligations.

Is This Confidential and Protected?

Yes. All payee and tax data are handled under full confidentiality and governed by the Data Privacy Act.

How Does This Connect with Other JKNC Products?

Certificate of Creditable Tax Withheld (Form 2307) Issuance

BIR Form 1601EQ (Quarterly Summary of 0619E)

Annual Information Return (Form 1604E)

Vendor Management and Tax Compliance Tracker

What Comes Next After This Deliverable?

Quarterly filing of 1601EQ (summarizing 3 months of 0619E)

Year-end reporting via Form 1604E

Optional: Convert to JKNC Monthly Tax Retainer with Auto-Filing and Certificate Generation

A monthly compliance solution for employers, payors, and corporations required to withhold tax under Sections 57 and 58 of the Philippine Tax Code.

Avoids stiff penalties and surcharges for late or incorrect withholding

Ensures supplier payments are legally supported by tax credit certificates (2307)

Strengthens audit-readiness and regulatory compliance

Enables continued tax deductibility of expenses subject to withholding

Submit list of payments made to suppliers, professionals, or other payees

JKNC calculates corresponding Expanded Withholding Tax rates

We prepare BIR Form 0619E, facilitate filing, and process payment if authorized

Review payee list and identify income classifications

Apply appropriate EWT rates (e.g., 5%, 2%, 10%, etc.)

Prepare BIR Form 0619E with monthly total

File electronically (eFPS/eBIRForms) or manually, depending on taxpayer class

Process tax payment and submit to AAB

Issue BIR-confirmed proof of filing and payment

BIR Certificate of Registration (with “Withholding Tax – Expanded” indicated)

Summary of payments made to individuals/entities during the month

Valid ID or authority letter of business owner (for manual payment)

Optional: Previous 0619E filings and Form 2307 records

Form 0619E preparation

Filing with BIR (manual or electronic)

Tax payment processing or payment instruction guide

Record archiving and acknowledgment from BIR

PDF of BIR Form 0619E + eFPS filing confirmation or stamped copy

Payment receipt + Summary of Withholding Ledger

Optional consult for first-time filers to understand EWT applications

In-person support available in Metro Cebu for bank-based payments