BIR Form 1601C Filing

Monthly Filing and Remittance of Withholding Tax on Employee Compensation

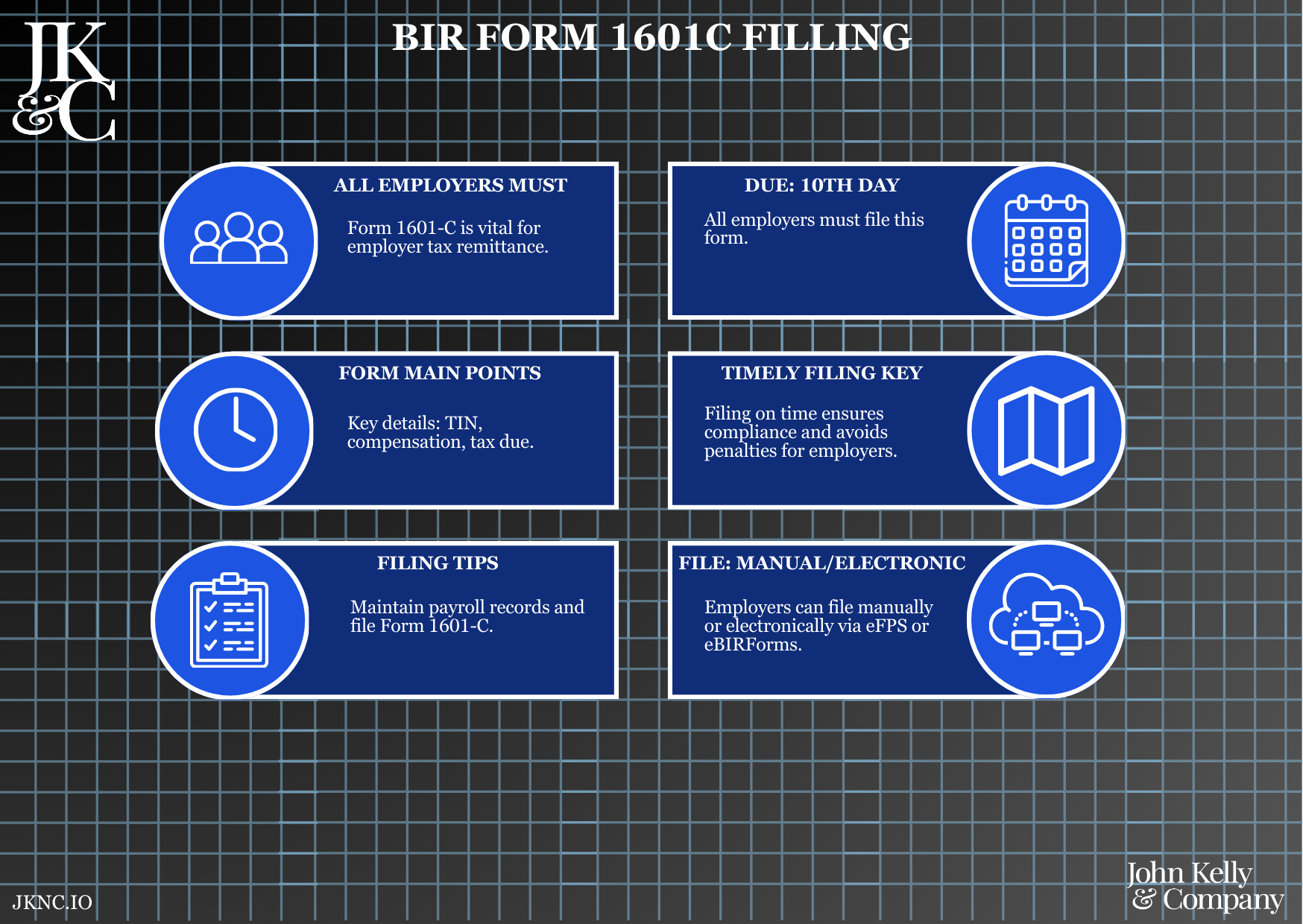

This service ensures accurate and timely filing of BIR Form 1601C, which covers the monthly remittance of withholding tax on employee salaries, benefits, and other taxable compensation. It is a mandatory requirement for all registered employers.

Who Is This For?

Any business with employees receiving compensation subject to withholding, including those with small teams, contractual staff, or monthly payroll.

How Long Does It Take?

2–3 business days (standard)

Rush option available for deadlines (10th of the following month)

What If I Don’t Have All My Information Yet?

JKNC can assist in payroll setup or data reconstruction, including employee tax profile verification.

Will JKNC Do the Filing/Execution?

Yes. We handle complete preparation, filing, and payment, unless advisory-only is selected.

Will It Be Accepted by Government Agencies and Bodies?

Yes. This is a core BIR compliance requirement under the Tax Code and used in cross-agency verifications.

Can Foreign Entities Use This?

Yes, if registered as employers with employees working in the Philippines.

Is This Confidential and Protected?

Absolutely. All salary, employee, and compensation data is processed securely and handled under strict confidentiality agreements.

How Does This Connect with Other JKNC Products?

Payroll Processing and Payslip Services

BIR Form 2316 Issuance

Alpha List Preparation and Upload

Annual 1604C Filing

DOLE and SSS-Pag-IBIG-PhilHealth Reporting

What Comes Next After This Deliverable?

Filing of Form 1604C (Annual Summary)

Issuance of Form 2316 to employees

Continued monthly filings

Optional: Upgrade to JKNC Full Payroll Compliance Retainer

A complete monthly tax compliance service that calculates, prepares, files, and remits withholding taxes withheld from employees' gross compensation.

Ensures full BIR compliance and avoids penalties

Aligns monthly payroll with tax filing

Protects employer from audit discrepancies on salaries and benefits

Enables the issuance of accurate BIR Form 2316 at year-end

Submit monthly payroll summary and employee tax status

JKNC computes and prepares Form 1601C

We coordinate filing and payment via eFPS/eBIRForms and AAB

Receive receipt and ledger confirmation

Intake of gross pay, deductions, and tax codes per employee

Application of withholding tax tables (monthly computation)

Preparation of Form 1601C

Filing via eFPS or manual (if required)

Payment facilitation and official receipt issuance

Ledger and compliance file update

Latest payroll register or monthly payslip summary

TIN and tax status of employees (if new hires)

Company BIR Certificate of Registration

Bank details or authority (if JKNC to handle payment)

Monthly filing and payment of Form 1601C

Filing confirmation and payment receipt

Optional reconciliation with 2316/Alpha List

PDF Form 1601C + eFPS filing proof or stamped RDO copy

Tax Payment Confirmation / BIR Payment Receipt

Optional onboarding Zoom call for first-time employer filers

In-person payroll coordination for clients in Metro Cebu