BIR Form 1601EQ Filing

Quarterly Expanded Withholding Tax Return (Form 1601EQ).

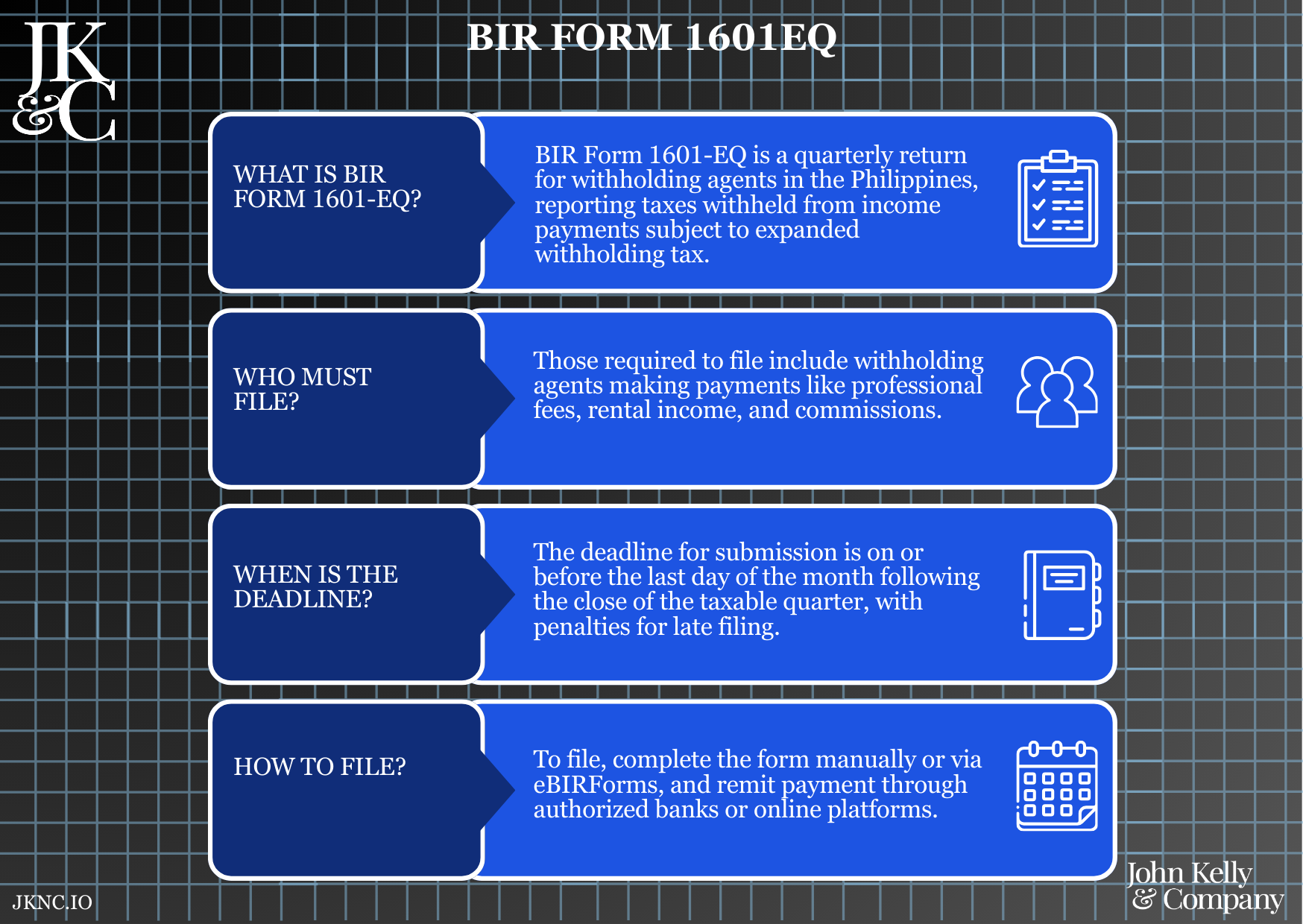

This service ensures the correct filing of BIR Form 1601EQ, the quarterly consolidated return for Expanded Withholding Tax (EWT). It summarizes three months of 0619E filings and is required for all withholding agents to remain fully compliant.

Who Is This For?

Any business or employer who has filed 0619E in the past three months or withheld tax on supplier, rental, or professional payments.

How Long Does It Take?

2–4 business days, depending on payee count and reconciliation needs

Rush filing available for late-month submissions

What If I Don’t Have All My Information Yet?

JKNC can reconstruct quarterly records using 2307s or payee lists; we also offer a full audit of your EWT data.

Will JKNC Do the Filing/Execution?

Yes. JKNC handles everything—from prep to eFPS submission and ledger validation—unless prep-only is selected.

Will It Be Accepted by Government Agencies and Bodies?

Yes. This filing is mandatory and fully recognized by the BIR for audit, inspection, and record purposes.

Can Foreign Entities Use This?

Yes, if they are registered withholding agents in the Philippines with local payees or contractors.

Is This Confidential and Protected?

Yes. All payee and tax data are securely processed in accordance with the Philippine Data Privacy Act.

How Does This Connect with Other JKNC Products?

0619E Monthly Withholding Filing

2307 Certificate Generation

1604E Annual Withholding Tax Return

Government Tax Ledger Monitoring

What Comes Next After This Deliverable?

Filing of Form 1604E (annual summary of all EWT)

Distribution of 2307s to payees

Optional: Add to JKNC’s Quarterly Compliance Retainer for auto-tracking

A quarterly summary and declaration of expanded withholding tax obligations, covering all payments and remittances made for the quarter to BIR-registered suppliers, professionals, or landlords.

Complies with mandatory quarterly withholding tax rules

Prevents penalties for missing or inaccurate EWT declarations

Ensures alignment between monthly 0619E filings and annual 1604E return

Supports issuance of accurate 2307s to suppliers and contractors

Submit 0619E filings or payee summary for the quarter

JKNC reconciles payments and prepares Form 1601EQ

We handle eFPS/eBIRForms filing and return filing confirmation

Collect and validate monthly 0619E submissions

Cross-check amounts per payee and category

Consolidate EWT amounts and populate Form 1601EQ

File return via BIR-approved channels

Issue official proof of submission and payment guide

Optionally, generate linked 2307s and coordinate annual reporting alignment

Previous 0619E forms for the quarter

TIN and Certificate of Registration (COR)

List of income payments and payees

Any certificates already issued (optional for validation)

Quarter-based Form 1601EQ filing

Consolidation of EWT data from 0619E

Submission and confirmation of BIR compliance

Optional: Certificate verification and ledger management

Filed BIR Form 1601EQ (PDF)

BIR Acknowledgment Receipt or eFPS confirmation

EWT Ledger Snapshot (optional)

Online briefing (if first-time filing)

In-person support available within Metro Cebu