BIR Form 1604C Filing

Annual Information Return of Compensation and Taxes Withheld from Employees

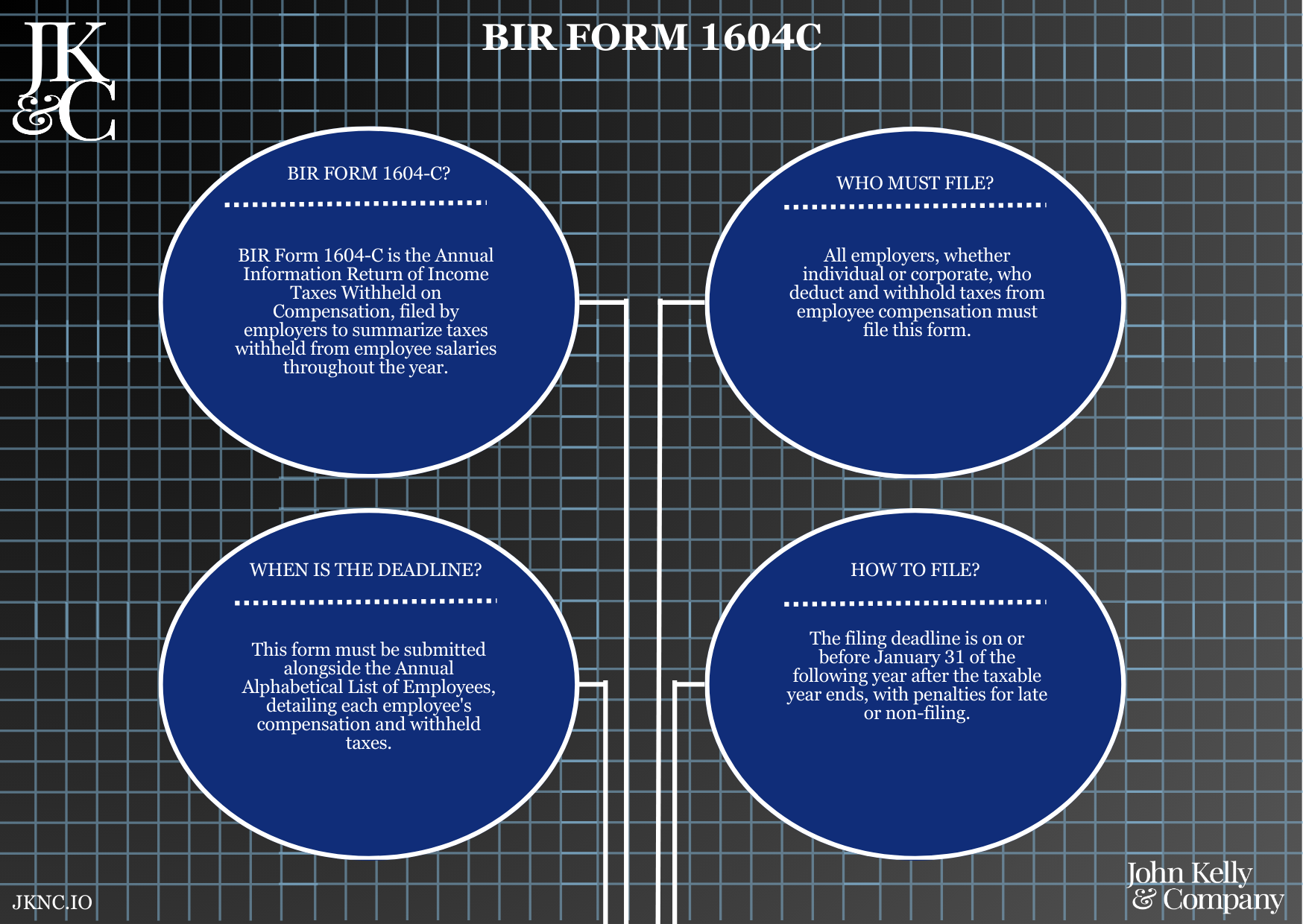

This service completes and files the BIR Form 1604C, which is the annual summary of all monthly 1601C filings. It reports all compensation payments made and taxes withheld from employees throughout the calendar year and supports the legal issuance of BIR Form 2316 per employee.

Who Is This For?

Any employer that filed 1601C throughout the year or withheld compensation taxes from staff, including corporations, OPCs, partnerships, and NGOs.

How Long Does It Take?

5–10 business days depending on payroll complexity and employee count

Rush services available before January 31 deadline

What If I Don’t Have All My Information Yet?

JKNC can reconstruct payroll records, regenerate Alpha Lists, or assist in creating Form 2316 based on payslips and ledgers.

Will JKNC Do the Filing/Execution?

Yes. JKNC will prepare, validate, and file with BIR—including Alpha List generation unless you opt for advisory-only.

Will It Be Accepted by Government Agencies and Bodies?

Yes. BIR Form 1604C is a required annual return and must be filed to maintain compliance.

Can Foreign Entities Use This?

Yes, if registered locally and employing workers in the Philippines with tax withheld.

Is This Confidential and Protected?

Yes. All payroll, employee, and compensation data are protected by strict JKNC confidentiality and data privacy protocols.

How Does This Connect with Other JKNC Products?

BIR Form 1601C Monthly Filing

Form 2316 Issuance and Signing

Alpha List Generation and Upload

HR Compliance Kit and DOLE Registration

What Comes Next After This Deliverable?

Distribution of Form 2316 to employees

Archive year-end payroll file for future audits

Optional: Add to JKNC Payroll Compliance Retainer for automation next year

A year-end payroll compliance service that consolidates employer remittances and matches government reporting obligations under the Philippine Tax Code.

Avoids BIR penalties for non-reporting or mismatched payroll filings

Ensures compliance for employee Form 2316 issuance

Required for tax clearance, permits, and audit preparedness

Helps reconcile total payroll vs. tax returns

Submit employee compensation records, 1601C, and 2316 data

JKNC validates payroll vs. tax withheld

Filing is completed, confirmed, and uploaded to BIR

Collect all monthly 1601C filings or payroll ledger

Validate employee-level withholding vs. Form 2316

Prepare and populate Form 1604C

Upload through BIR eBIRForms platform

Deliver official acknowledgment and archive year-end tax file

All 1601C filed for the year

TIN and tax status per employee

Form 2316 drafts or confirmed list of compensation payments

BIR COR and Employer TIN

Alpha List spreadsheet (JKNC can prepare if unavailable)

Annual 1604C form preparation and validation

Payroll vs. tax reconciliation

Filing confirmation via eBIRForms

Optional: Certificate of Annual Compliance Summary

PDF Form 1604C + BIR submission confirmation

Archived Alpha List + 2316 verification memo

Optional compliance briefing (Zoom)

On-site assistance for Alpha List upload (if required)