BIR Form 1604E Filing

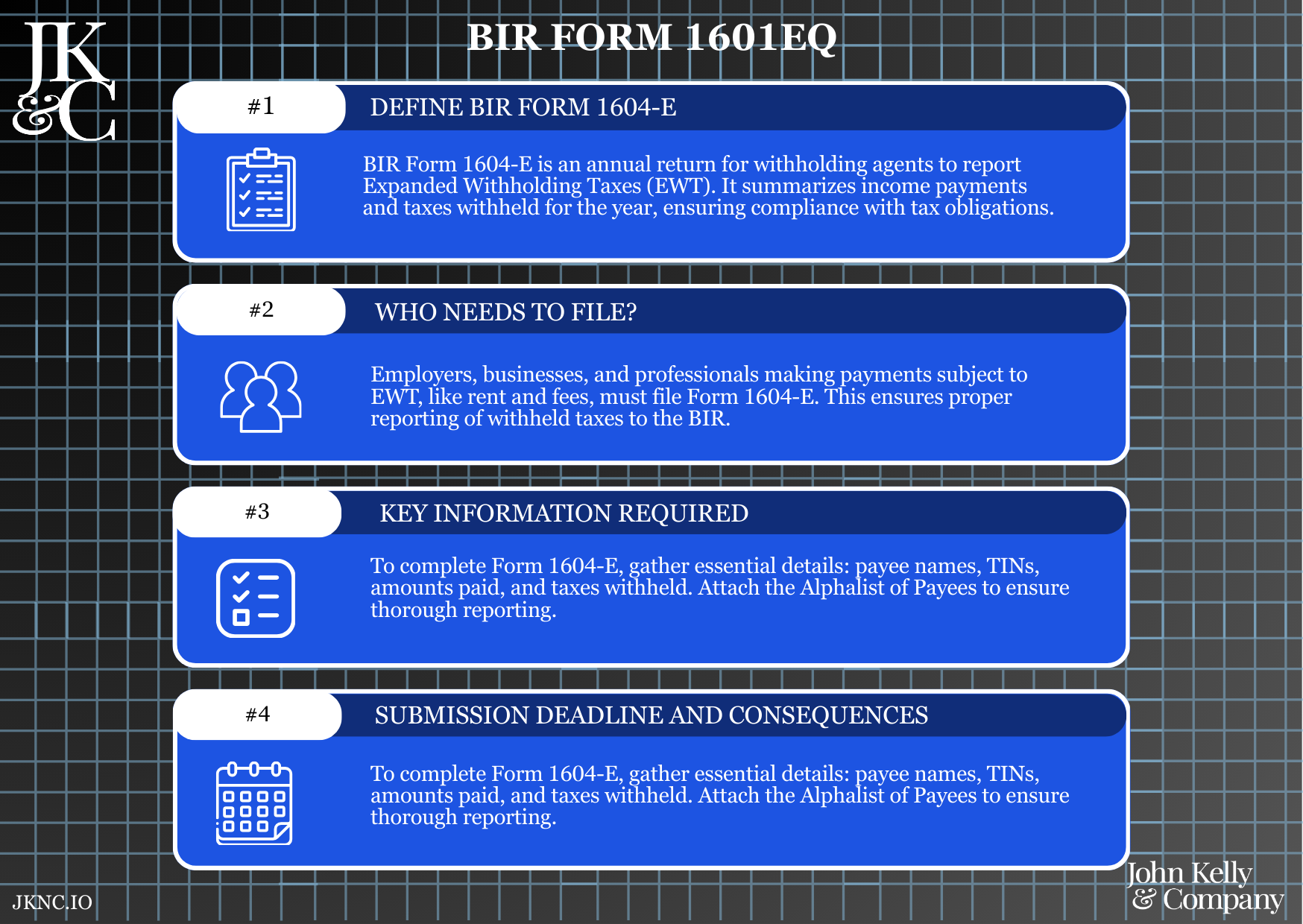

Annual Information Return of Income Payments Subject to Expanded Withholding Taxes

This service covers the preparation and filing of BIR Form 1604E, the annual summary of all income payments subject to Expanded Withholding Tax (EWT). This filing reconciles all 0619E and 1601EQ submissions made throughout the year and supports the issuance of Form 2307s to payees.

Who Is This For?

All BIR-registered withholding agents who made payments subject to EWT during the previous calendar year, including corporations, OPCs, SMEs, and service firms.

How Long Does It Take?

5–7 business days for full reconciliation

Rush support available mid-February before March 1 deadline

What If I Don’t Have All My Information Yet?

JKNC can reconstruct your year using Form 2307s issued or help regenerate missing data using your vendor payment records.

Will JKNC Do the Filing/Execution?

Yes. Unless advisory-only is selected, JKNC handles filing, validation, and official compliance archiving.

Will It Be Accepted by Government Agencies and Bodies?

Yes. This is a mandatory annual requirement under the Philippine Tax Code and subject to audit.

Can Foreign Entities Use This?

Yes, if registered locally and have made payments requiring expanded withholding within the Philippines.

Is This Confidential and Protected?

Yes. All payee, vendor, and tax data are encrypted and processed under strict confidentiality protocols.

How Does This Connect with Other JKNC Products?

0619E and 1601EQ Filing Services

Certificate of Creditable Tax Withheld (Form 2307) Issuance

Vendor Tax Ledger Maintenance

Annual Compliance & Tax Calendar Retainers

What Comes Next After This Deliverable?

Issue Form 2307 to suppliers and professionals

Align with Form 1702/1701 for your own ITR filing

Archive EWT proof for 3–5 years (audit window)

Optional: Bundle with JKNC’s Annual Tax Compliance Folder for seamless government inspections

An annual EWT compliance requirement that summarizes total withholdings for the year, validates BIR records, and supports the annual issuance of tax certificates to suppliers and service providers.

Ensures total compliance with BIR EWT rules

Avoids penalties and audit flags from missing or mismatched reports

Validates all Form 2307s issued or to be issued

Required for audit readiness and supplier cross-validation

Submit 0619E and 1601EQ copies or EWT ledger

JKNC prepares BIR Form 1604E based on consolidated data

We submit via eFPS or eBIRForms and issue confirmation

Optional: JKNC helps validate and prepare Form 2307s for suppliers

Intake of EWT records: 0619E, 1601EQ, or EWT ledger

Reconciliation of monthly/quarterly withholding declarations

Review of payees, TINs, and withheld amounts

Populate Form 1604E and validate figures

Submit electronically to BIR before the March 1 deadline

Issue archive package with filing proof and summary report

TIN and BIR Certificate of Registration

All 0619E and 1601EQ filed for the year

Payee list with TINs and total income paid/withheld

Optional: 2307 copies or ledger (if certificates already issued)

Annual Form 1604E preparation and filing

Consolidation of all EWT activities for the previous year

Cross-checking of payee data

Optional support for correcting missed withholdings or misclassified payments

Filed Form 1604E (PDF)

eFPS/eBIRForms submission confirmation

EWT Annual Summary Report

Optional Zoom consult for businesses with many suppliers or freelancers

In-person filing support (Metro Cebu)