BIR Form 1702 Filing

Annual Corporate Income Tax Return Preparation and Filing

This service ensures your BIR Form 1702 is properly prepared, computed, and filed in compliance with Philippine tax laws. It includes reviewing your financials, validating tax deductibles, and completing your Annual Corporate Income Tax Return to avoid penalties and ensure legal compliance.

Who Is This For?

All domestic corporations operating in the Philippines required to file annual income tax returns, including those with zero income or losses.

How Long Does It Take?

7–14 business days (prep and filing)

Urgent/rush filing subject to express surcharge

What If I Don’t Have All My Information Yet?

JKNC can assist in organizing records, performing accounting catch-up, or liaising with your external accountant.

Will JKNC Do the Filing/Execution?

Yes. Unless advisory-only is selected, JKNC handles end-to-end filing and confirmation.

Will It Be Accepted by Government Agencies and Bodies?

Yes. Our filings are submitted directly to the BIR via eFPS or manual channels with full compliance.

Can Foreign Entities Use This?

Yes, if registered as domestic corporations or subsidiaries with income-generating operations in the Philippines.

Is This Confidential and Protected?

Absolutely. All financial, tax, and business data are protected by NDAs and the Data Privacy Act.

How Does This Connect with Other JKNC Products?

Monthly Bookkeeping

Quarterly Income Tax Filing (1702Q)

Annual Audited FS Preparation

Tax Health Check & Optimization Report

What Comes Next After This Deliverable?

Filing of Q1 Form 1702Q

Renewal of business permits next calendar year

Use of Form 1702 data in bank certifications and investor reporting

Optional: Enroll in JKNC’s Full-Year Tax & Compliance Retainer

A full-service corporate tax return filing based on audited or compiled financials, filed using Form 1702 for domestic corporations.

Prevents late filing penalties and tax surcharges

Aligns financial reporting with annual BIR expectations

Reduces audit risk through accurate declarations

Ensures your business remains in good standing for loans, permits, and certifications

Submit your financials or accounting records

JKNC prepares the return, reviews with your team, and finalizes filing

Confirmation and receipt are provided for audit trail

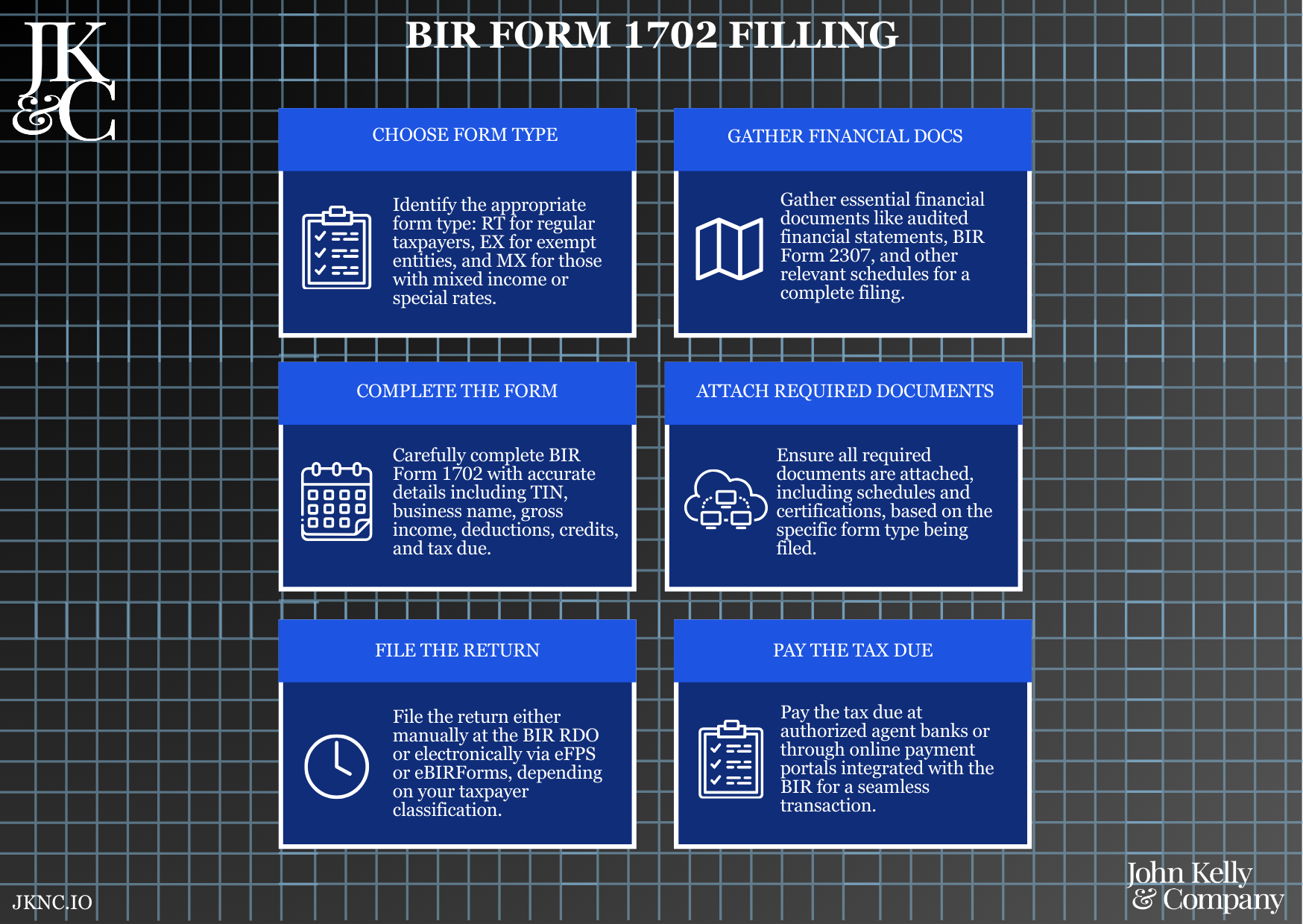

Intake of accounting documents and financials

Validation of taxable income and deductions

Drafting and review of BIR Form 1702

E-filing or in-person filing depending on BIR registration

Issuance of official receipt, stamped form, or e-file proof

Archive documents and prepare audit-ready file

Financial statements (audited or compiled)

BIR Certificate of Registration (COR)

Previous year’s Form 1702 (if applicable)

Summary of taxes paid (e.g., 2307, 2306)

Valid ID of authorized signatory

Form 1702 preparation

Corporate income tax computation

Filing coordination with RDO

Delivery of filing confirmation

Optional: Payment facilitation and audit support

PDF of Form 1702 + BIR submission proof (eFPS receipt or manual stamp)

Summary tax memo for corporate records

Optional tax briefing via Zoom

Filing walkthrough for in-house accountants (if needed)