BIR Form 1702Q Filing

Quarterly Corporate Income Tax Return Filing using Form 1702Q.

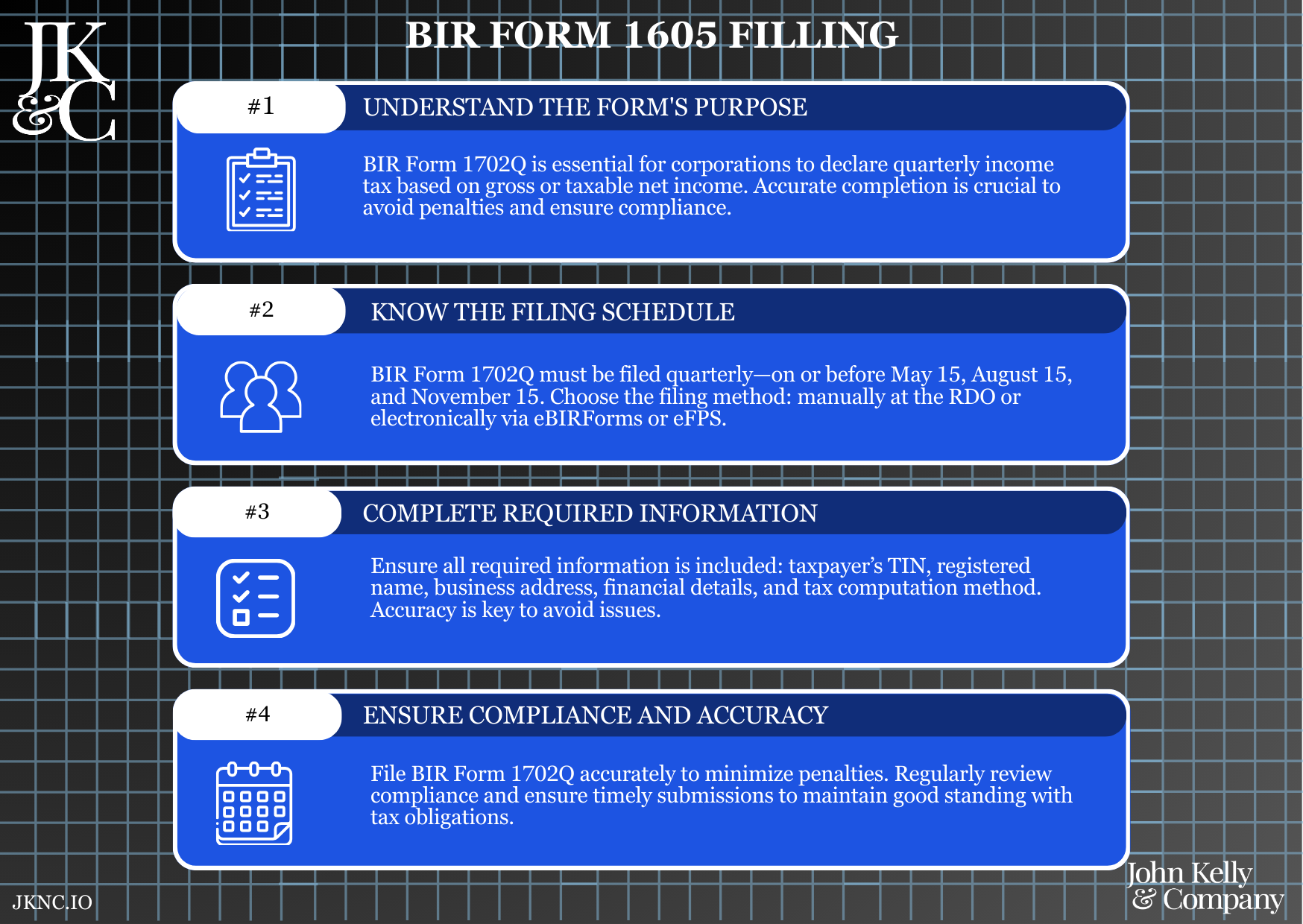

This service supports the quarterly filing of your corporate income tax return using BIR Form 1702Q, as required by law. It ensures correct computation of quarterly income tax based on financial performance and accurate submission within the 60-day period post-quarter close.

Who Is This For?

Domestic corporations registered with BIR, regardless of revenue, who must comply with quarterly income tax reporting under the TRAIN law.

How Long Does It Take?

Typically 3–5 business days per quarter, assuming timely submission of records. Rush filing support available (subject to availability).

What If I Don’t Have All My Information Yet?

JKNC offers financial reconstruction services or can coordinate with your accountant to complete the quarter.

Will JKNC Do the Filing/Execution?

Yes. Unless you choose advisory-only, JKNC manages filing, submission, and optional payment handling.

Will It Be Accepted by Government Agencies and Bodies?

Yes. Your 1702Q will be filed directly with BIR and acknowledged through standard compliance channels.

Can Foreign Entities Use This?

Yes, if they are domestic corporations or subsidiaries required to file quarterly tax returns.

Is This Confidential and Protected?

Yes. JKNC observes the strictest confidentiality, including encrypted file handling and NDAs if required.

How Does This Connect with Other JKNC Products?

Monthly Bookkeeping Service

BIR Form 1702 Annual Filing

Quarterly Withholding Tax Filings (1601EQ)

Full-Year Tax Calendar Planning

What Comes Next After This Deliverable?

Filing of next quarter’s 1702Q

Final Form 1702 Annual Return after Q4

Optional: Conversion to JKNC Full Tax Retainer for continuous support

A full quarterly compliance filing for domestic corporations, aligning declared income, tax due, and remittances for Q1, Q2, and Q3 of the taxable year.

Avoids penalties and surcharges from late or erroneous filings

Ensures accurate tax planning and quarterly cash flow forecasting

Supports proper documentation for loans, audits, and expansions

Keeps your compliance status in good standing with BIR

Submit your Q1–Q3 financials or sales summaries

JKNC prepares the tax computation and fills Form 1702Q

You review and sign, or authorize e-sign filing

JKNC submits and issues proof of receipt + tax payment instructions

Client onboarding and quarterly records intake

Review of revenue, expense, and prior payments

Tax due computation under corporate rates (RCIT/MCIT)

Drafting of Form 1702Q and coordination of digital/physical filing

Payment facilitation (optional) and document archiving

Preparation of audit-ready tax folder (upon request)

Quarterly financial reports (or book summaries)

Proof of prior tax payments (if any)

BIR Certificate of Registration (COR)

Authorized signatory ID

eFPS credentials (if applicable)

One-quarter coverage (Q1, Q2, or Q3 only)

Full tax computation and declaration

Filing with BIR (online or manual)

Optional payment support

Submission confirmation and compliance archiving

PDF Form 1702Q + BIR eFPS/eBIRForms proof of submission

Compliance Certificate / Filing Acknowledgment

Zoom call for briefing (upon request)

Onsite submission support (Metro Cebu only)