BIR Form 2550Q Filing

Quarterly Value-Added Tax Return Preparation and Filing for VAT-Registered Entities

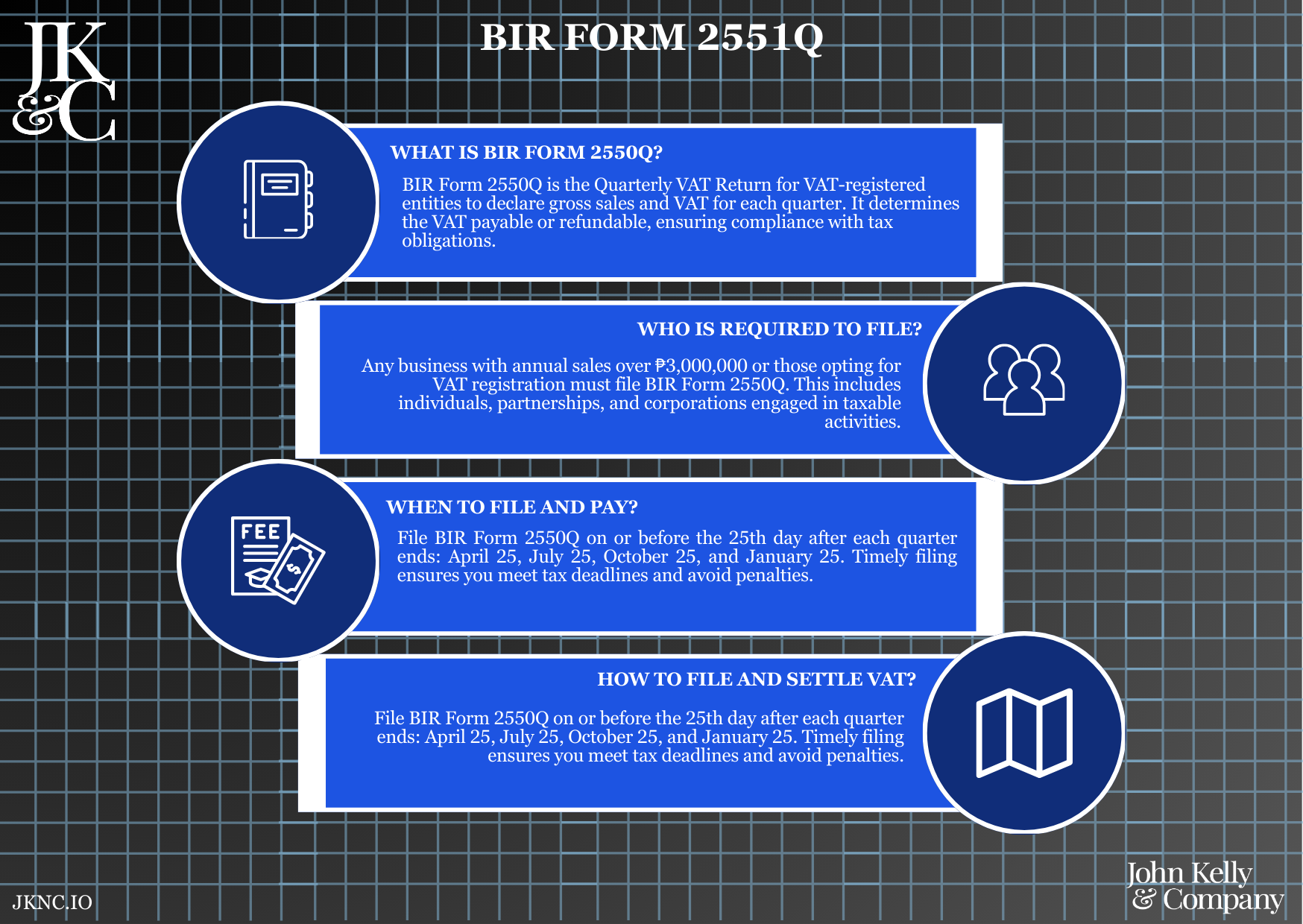

This service supports the accurate and timely filing of BIR Form 2550Q, required for all VAT-registered businesses in the Philippines. JKNC handles computation of Output VAT and Input VAT, ensures correct reconciliation, and coordinates submission to the BIR.

Who Is This For?

All VAT-registered entities, including corporations, OPCs, partnerships, and professionals exceeding ₱3M in gross sales or registered voluntarily for VAT purposes.

How Long Does It Take?

3–7 business days from complete record submission

Rush options available for near-deadline compliance

What If I Don’t Have All My Information Yet?

JKNC offers a VAT Catch-Up Kit and can reconstruct quarterly VAT books from receipts and ledgers.

Will JKNC Do the Filing/Execution?

Yes. Full preparation, reconciliation, and filing—unless advisory-only is selected.

Will It Be Accepted by Government Agencies and Bodies?

Yes. All filings are officially submitted to the BIR and valid for audit, VAT refund, and government transactions.

Can Foreign Entities Use This?

Yes, if registered as Philippine VAT taxpayers or PEZA/BOI VAT-exempt with local reporting obligations.

Is This Confidential and Protected?

Yes. JKNC processes all VAT-related records under strict confidentiality with encrypted data channels and access control.

How Does This Connect with Other JKNC Products?

Monthly VAT Bookkeeping

VAT Audit and Optimization Review

BIR Form 2550M (if applicable pre-2023)

Form 0605 for Annual Registration

Full-Year Compliance & Tax Health Monitoring

What Comes Next After This Deliverable?

Next quarter’s VAT filing

Integration with Income Tax Filings (Form 1702Q/1702)

Optional: Upgrade to JKNC Quarterly Compliance Tracker for automated alerts and filing schedules

A complete quarterly VAT compliance filing solution for businesses with VAT obligations, ensuring full regulatory alignment and zero-penalty operations.

Ensures proper Input/Output VAT tracking

Prevents penalties, surcharges, and filing disqualifications

Supports financial audit trail and cash flow visibility

Validates VAT claim deductions and credits for large or multi-branch businesses

Submit sales and purchase records for the quarter

JKNC prepares Form 2550Q and validates VAT positioning

You approve and sign or authorize us to file electronically

Confirmation of submission and tax payment proof is issued

Collect VAT sales invoices and official receipts

Review Input VAT from eligible purchases

Reconcile VAT payable and any carry-over credits

Draft Form 2550Q and verify BIR computations

Submit via eFPS or eBIRForms (or manually for specific RDOs)

Coordinate payment, generate confirmation, and archive audit trail

BIR Certificate of Registration (with VAT indicated)

Quarterly sales and expense records with VAT breakdown

Summary of Input and Output VAT

Previous VAT filings (if applicable)

eFPS credentials (if authorized for e-submission)

One-quarter filing of Form 2550Q

VAT reconciliation and positioning report

Official BIR submission and payment guidance or facilitation

Output: Compliance Folder and Audit File (PDF/Physical)

Filed PDF Form 2550Q + BIR receipt/eFPS confirmation

Optional VAT Reconciliation Report

Optional Zoom walkthrough on Input/Output VAT treatment

On-site document assistance for large-volume clients (Metro Cebu)