BIR Form 2551Q Filing

Quarterly Percentage Tax Return Preparation and Filing for Non-VAT Taxpayers

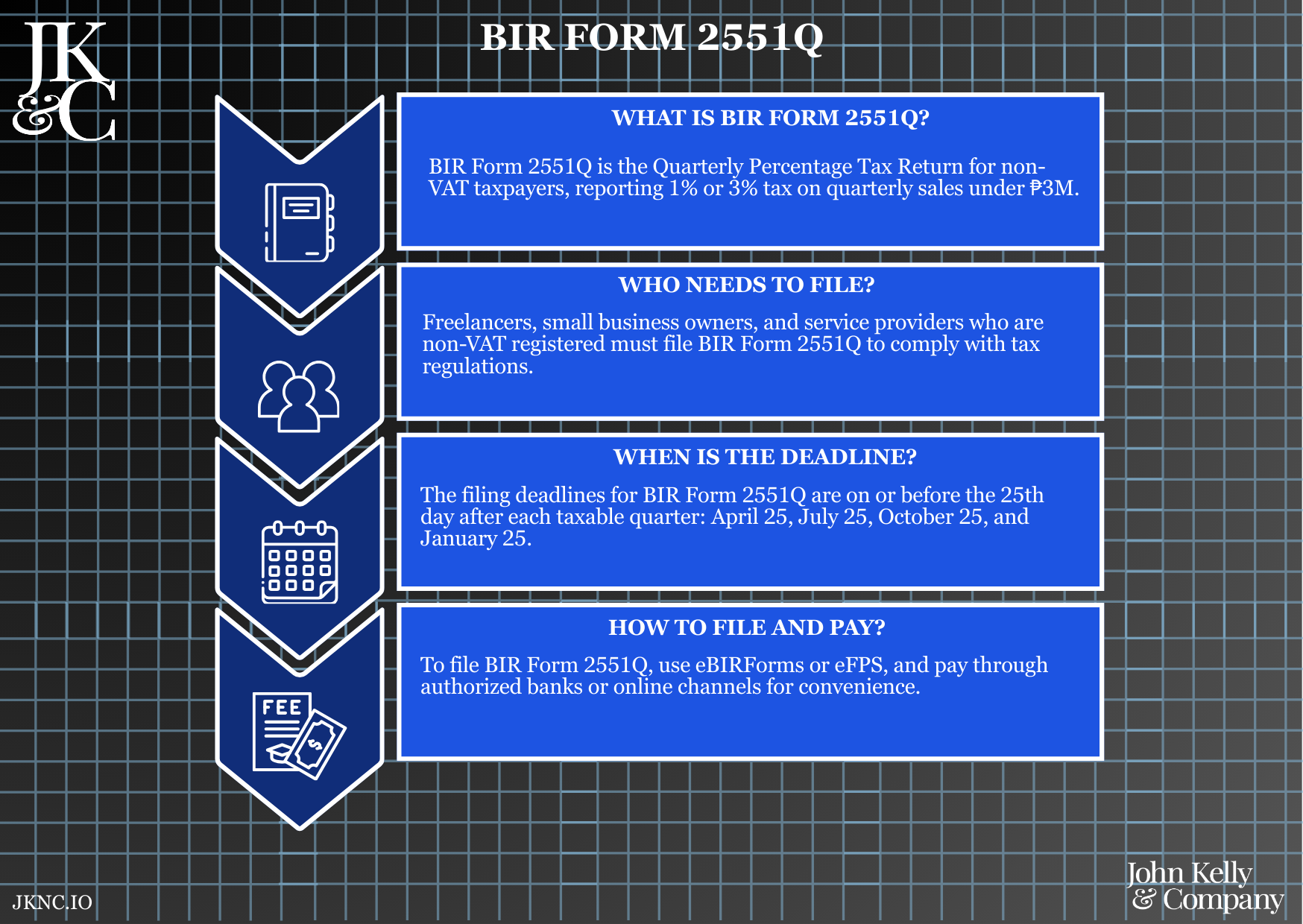

This service manages the preparation, computation, and filing of BIR Form 2551Q, required quarterly by non-VAT registered businesses under the Percentage Tax scheme. JKNC ensures you file accurately, avoid penalties, and maintain a clean tax record.

Who Is This For?

Non-VAT registered businesses, freelancers, and professionals earning ₱3M or less annually and subject to Percentage Tax under the TRAIN law.

How Long Does It Take?

Standard turnaround: 2–3 business days

Rush filing (within 48 hours) available for urgent cases

What If I Don’t Have All My Information Yet?

JKNC can help reconstruct your sales report or generate a compliance summary from your available receipts or platforms (e.g., PayPal, GCash, Shopee, etc.).

Will JKNC Do the Filing/Execution?

Yes. We handle everything—preparation, submission, and payment confirmation—unless you prefer advisory-only.

Will It Be Accepted by Government Agencies and Bodies?

Yes. Filed directly with BIR, stamped or acknowledged as valid for audit, licensing, and grant applications.

Can Foreign Entities Use This?

Only if they are registered in the Philippines as non-VAT domestic taxpayers.

Is This Confidential and Protected?

Yes. All financial records and ID documents are processed securely under NDAs and JKNC’s data privacy policy.

How Does This Connect with Other JKNC Products?

Bookkeeping Services for Non-VAT Entities

Form 0605 Annual Registration

Income Tax Filing (Form 1701 or 1702)

Government Retainer Packages

What Comes Next After This Deliverable?

Filing of next 2551Q within the next quarter

Preparation for Annual ITR Filing

Optional upgrade to JKNC Quarterly Filing Retainer for automated processing

A quarterly tax compliance solution for Percentage Tax filers, applicable to small businesses, professionals, and non-VAT registered entities.

Meets mandatory tax requirements under the TRAIN law

Prevents penalties, surcharges, and late filing notices

Builds a clean tax history for future loan or grant applications

Supports freelancers, online sellers, service providers, and small merchants

Submit gross sales/income data per quarter

JKNC computes the tax due and fills out BIR Form 2551Q

You sign (or authorize digital filing), and JKNC files and returns proof

Receive sales summary or books of accounts

Apply correct 1% / 3% tax rate based on your classification

Prepare Form 2551Q and validate computation

File via eBIRForms or manual route (if required by RDO)

Coordinate payment (online or over-the-counter)

Deliver official submission proof and file for audit

BIR COR reflecting “Percentage Tax” under tax types

Quarterly sales summary or income report

Valid ID or authorization letter (if filing on client’s behalf)

Prior 2551Q (optional, for carry-over validation)

One quarter’s filing of Form 2551Q

Optional assistance with penalty/surcharge computation

Filing confirmation and archive file delivery

Payment coordination or guide

PDF of filed Form 2551Q + eSubmission proof or RDO-stamped copy

Tax due memo (if payment to be made by client directly)

Optional Zoom consult for compliance walkthrough

Onsite support available in Metro Cebu (additional fee may apply)