BIR New Business Registration

Register your business with BIR and secure TIN and COR.

This service registers your newly formed business with the Bureau of Internal Revenue (BIR). It covers securing a Taxpayer Identification Number (TIN), issuance of the Certificate of Registration (COR), registration of official books of account, and authorization to print (ATP) or use system-generated receipts.

Who Is This For?

Newly registered sole proprietors, partnerships, OPCs, and corporations who need to comply with BIR before starting operations or issuing invoices.

How Long Does It Take?

5–10 business days depending on RDO volume and document completeness.

What If I Don’t Have All My Information Yet?

JKNC will help compile, format, and complete all needed documentation and guide you through any local requirement gaps.

Will JKNC Do the Filing/Execution?

Yes. This is an end-to-end service unless advisory-only is selected.

Will It Be Accepted by Government Agencies and Bodies?

Yes. All filings comply with BIR standards and are valid nationwide for all tax and regulatory transactions.

Can Foreign Entities Use This?

Yes, provided the business is properly registered with SEC or DTI and local address requirements are met. JKNC will advise on foreign compliance nuances.

Is This Confidential and Protected?

Absolutely. All TIN and tax data is processed securely and in compliance with the Data Privacy Act.

How Does This Connect with Other JKNC Products?

SEC or DTI Registration (prior step)

LGU Permits and Licensing

Monthly and Annual Tax Filing Retainer

Bookkeeping & Virtual CFO Services

What Comes Next After This Deliverable?

Begin tax filing (monthly, quarterly, annual)

Enroll in online BIR platforms (eFPS or eBIRForms)

Comply with VAT, Withholding Tax, and other obligations

Optional add-on: Tax Compliance Monitoring and Filing Retainer

A full-service engagement to legalize your tax identity with the BIR—ensuring you're recognized as a taxpayer and ready for compliant operations, invoicing, and reporting.

Establishes your legal tax identity and obligations

Allows you to issue valid official receipts or sales invoices

Avoids penalties for unregistered operations

Aligns you for LGU, SEC/DTI, and client billing requirements

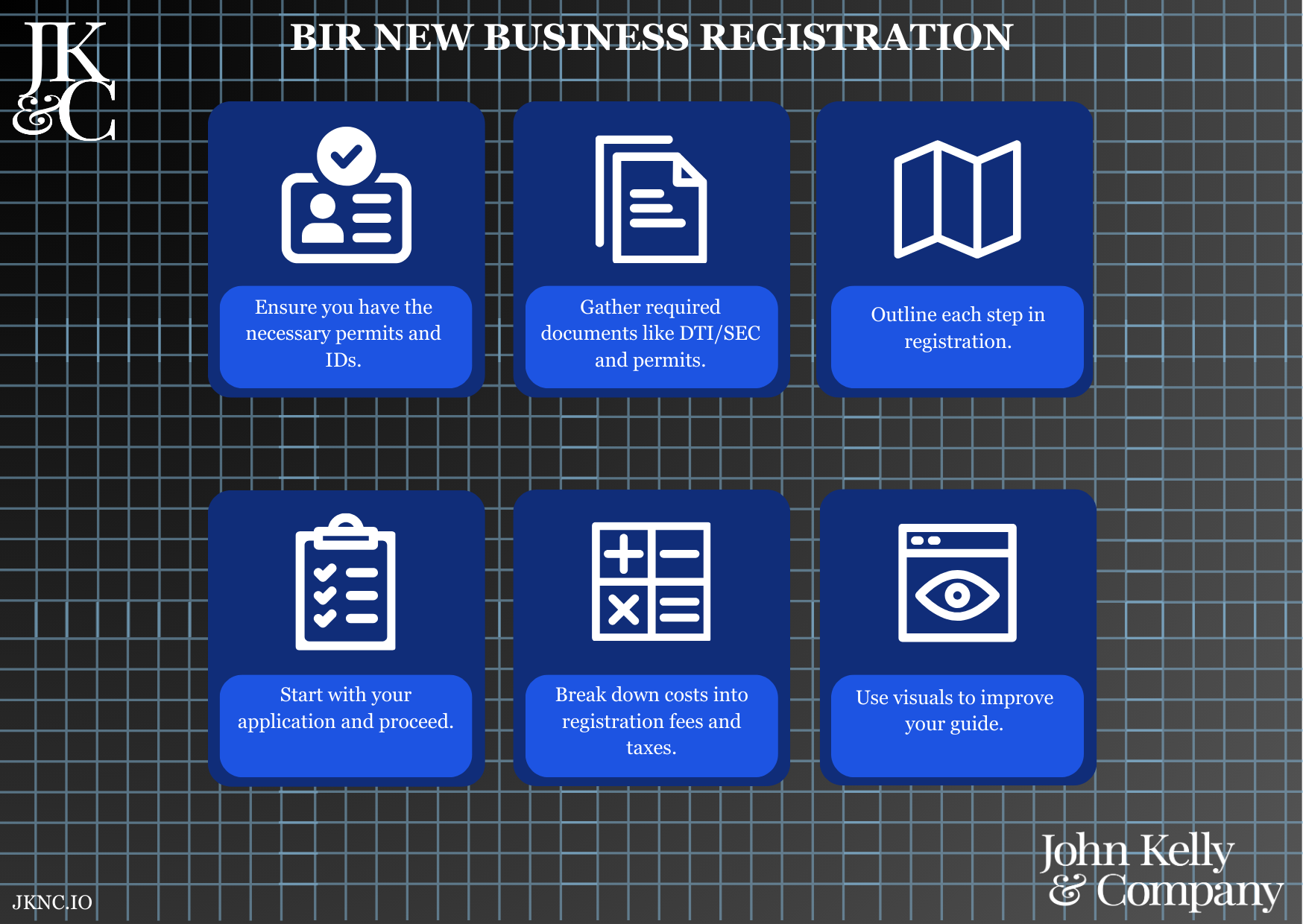

Submit required documents (e.g., SEC Certificate, Mayor’s Permit, valid ID)

JKNC handles coordination with your Revenue District Office (RDO)

Receive official BIR Certificate of Registration and supporting documents

Verify client readiness and required filings

Complete BIR forms (1901/1903/1905 as applicable)

Coordinate with appropriate RDO for appointment and queueing

Submit documents and secure Certificate of Registration

Register Books of Account and apply for ATP or POS system permit

Deliver tax file kit to client, including tax calendar and guidance

SEC Certificate or DTI Certificate

Mayor’s Permit (or proof of application)

Lease contract or proof of business address

Valid ID of business owner or corporate officers

Barangay Clearance

BIR forms (signed) + printed books (if physical)

TIN registration (or validation)

COR issuance

Registration of Books of Account (manual or system-generated)

ATP or POS permit (if applicable)

Client orientation guide and tax calendar

Hard copy kit with BIR Certificate, Books, and stamped forms

PDF soft copies also provided

Optional onboarding session with tax reminders and obligations overview

Online support available for questions on use of ORs or filing requirements