SSS Employer Registration

Enrollment of Your Business as an Employer with the Social Security System

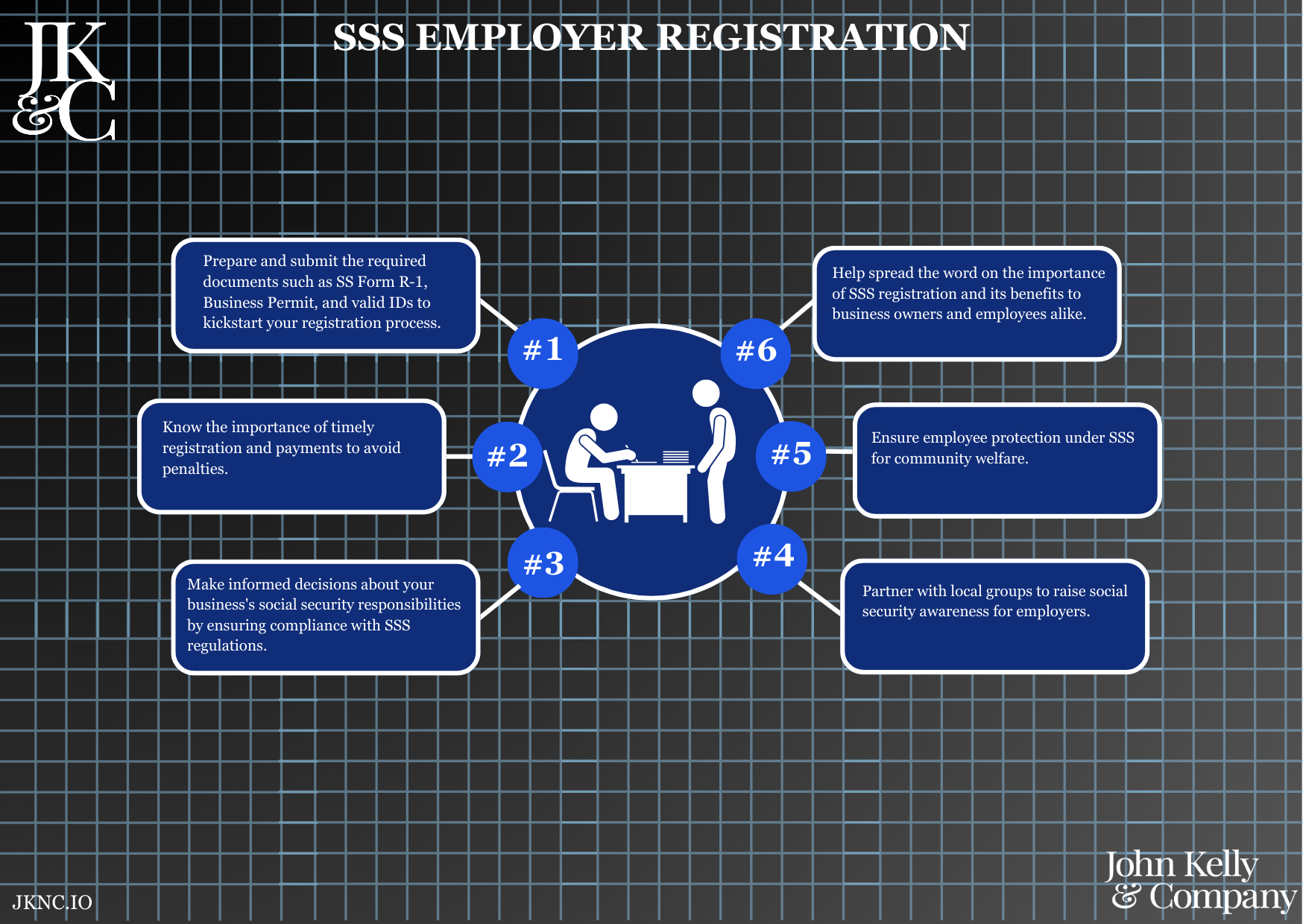

This service registers your business with the Social Security System (SSS) as an employer—ensuring you are legally recognized to remit social security contributions for your employees. JKNC handles the preparation and submission of required forms, including R1 and R1A, and coordinates ID issuance.

Who Is This For?

All businesses with at least one employee (even part-time or probationary) that require SSS enrollment. Also essential for compliance with DOLE and payroll audits.

How Long Does It Take?

3–7 business days depending on SSS branch volume and documentary readiness.

What If I Don’t Have All My Information Yet?

JKNC can help generate employee profiles, complete Form E-1s, and guide you through late registration scenarios.

Will JKNC Do the Filing/Execution?

Yes. End-to-end coordination and filing are included unless advisory-only is selected.

Will It Be Accepted by Government Agencies and Bodies?

Yes. This registration is officially processed by SSS and is a legal requirement for payroll and HR compliance.

Can Foreign Entities Use This?

Yes, if the foreign business is registered locally with employees in the Philippines. JKNC can advise on foreign-employer compliance.

Is This Confidential and Protected?

Yes. Employee data and company registration details are treated with full confidentiality in accordance with the Data Privacy Act.

How Does This Connect with Other JKNC Products?

Pag-IBIG and PhilHealth Employer Registration

DOLE Registration (Establishment Report)

Payroll Setup & HR Compliance Kits

Monthly Government Remittance Service

What Comes Next After This Deliverable?

Start monthly SSS contribution filing

Monitor employee additions/removals

Comply with SSS Form R3, R5, and online payment requirements

Optional: Add to JKNC Government Filing Retainer for hassle-free processing

A full registration service for new employers with the SSS, enabling your business to comply with mandatory government contributions and legalize your employee-employer relationship.

Enables you to legally hire employees

Ensures compliance with labor and social welfare laws

Prevents penalties, disqualification, or government sanctions

Supports employees’ benefits eligibility (sickness, maternity, pension)

Submit business registration documents and employee list

JKNC completes and files SSS employer forms

Receive official Employer ID and confirmation from SSS

Review business registration and confirm employee headcount

Prepare SSS R1 (Employer Registration) and R1A (Employee List) forms

Secure supporting documentation (SEC/DTI, BIR COR, Mayor’s Permit)

File at assigned SSS Branch

Coordinate ID and registration number issuance

Provide official confirmation and next steps for remittances

SEC or DTI Certificate

BIR Certificate of Registration (COR)

Mayor’s Permit

Valid IDs of owner or authorized representative

Employee list with birthdates, addresses, and SSS numbers (or Form E-1 for new employees)

Sketch or map of business location

Preparation and filing of R1 and R1A

SSS branch coordination and compliance processing

Issuance of Employer Number

Employee list validation

Advisory on first remittance and contribution reporting

PDF copy of R1, R1A, and Employer ID Notice + Filing Receipt (hard copy if required)

Optional session to explain employer obligations, penalties, and monthly deadlines

Can be bundled with HR Onboarding Workshop